Good Reasons to Consider Prepaid Cards

Workers typically love being paid by payroll card—AKA prepaid card—rather than conventional paper check or direct deposit to a bank account. (That’s so 2010.)

Payroll cards have proven themselves to be valuable financial instruments through which workers can receive wages, manage their finances, and view recent transactions.Increasingly, organizations are using prepaid cards to make payroll—and for good reason: They act a lot like credit or debit cards but are less expensive.

With these advantages, it’s no surprise that the payroll card industry has grown rapidly in recent years. In 2014, the industry grew at an annualized rate of 9 percent to $33.5billion USD in load volume. A compound annual growth rate of 6 percent is forecast through 2018 when load volume is expected to reach $42.3 USD billion.

Desirable Features

Why are payroll cards in such high demand?

First, they can be used anywhere a Visa debit card is accepted. Second, they include basic features and functionality such as convenient, accessible customer service and clear, easy-to-understand fee schedules. They are considered to be high-quality products.

In offering the payroll card option, program managers can go beyond the basics by offering features that help employees build financial health without needing to open a bank account. These include online videos and tutorials, proactive customer service, subaccounts, savings platforms, and budgeting tools. Program managers and other members of the payroll card value chain can continue to improve their programs by adopting newer features such as biometric authentication, real-time intelligence, and the ability to transform cross-border payments.

What’s Behind Payroll Card Industry Growth?

Adoption of payroll cards both by those who have bank accounts and those who do not have driven the growth of the industry. Today, nearly half of payroll card users have bank accounts. For those who do not, they offer an affordable, safe, and convenient way to be paid. For employees with bank accounts, payroll cards offer an additional money management tool.

Being paid by check can be time-consuming and risky or inconvenient and annoying. Employees must either pick up a check or wait for it to arrive by mail. Then there’s the need for a trip to the bank or a check-cashing facility, which probably involves fees. Of course, there’s the risk of a lost check and the wait for a duplicate to be issued. Payroll cards can be easily replaced.

For employers, issuing paper checks is expensive: The average administrative cost is $6 USD or more per check, an amount that can be even higher when the disbursement process isn’t automated. Of course, there is also the risk of fraud if a check falls into the wrong hands.

Hourly vs. Salaried

Even with the growth of the industry, does the perception still exist that payroll cards are only for hourly workers?

It’s certainly true that payroll cards are regarded as a product for the unbanked. And it’s true that they offer a practical alternative for those employees. But payroll cards are great for anyone. In fact, the enthusiasm for them among millennials highlights their benefits.

We think these stats about prepaid card use will surprise you.

- According to recent research from TSYS, 25% of U.S.consumers use a prepaid card.

- 45% of these consumers are ages 19-35.

- More millennials use prepaid cards than credit cards.

- The best-paid millennials use their payroll cards more than less well-off peers.

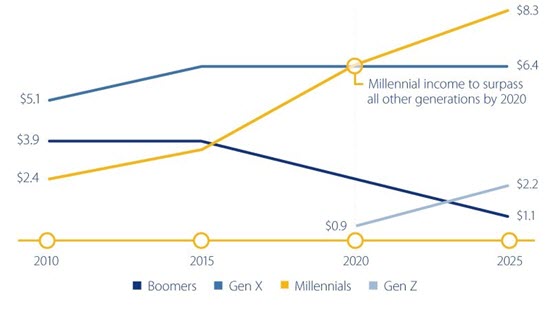

In the next four years—according to Visa—millennials will become the customer segment with the greatest personal income, growing to an aggregate $8.3 trillion USD by 2025. By then, millennials will represent 75 percent of the workforce and 46 percent of total U.S. income.

The growing 19-35 segment will increase its use of cards and related technologies as it grows older—and its expectations around how card programs should work differ from those of previous generations. Nearly 40 percent of millennials surveyed believe that a company offering more payment options cares about its employees.

Here are four reasons you should not miss out on the opportunity to adopt payroll cards:

- Millennials use prepaid cards more than other market segments.

- They are more likely to apply for credit.

- Their spending will increase as they age.

- They’re open to new and emerging payment products.

Making the move to a prepaid payroll card program isn’t a huge investment. Doing so will save companies time and money and free up resources to be used elsewhere.

On the Road

Freelancers are great candidates for payment by card. Kristen Sabol, a spokesperson for Guru.com, says, “Pay cards are a nice fit for the freelance lifestyle. A part of the allure of working for yourself is the flexibility to work when, where and how much you would like. Often, this means that freelancers will take work with them as they travel. With a pay card, you can easily collect your paycheck anywhere in the world without missing a beat.”

Prepaid solutions also integrate perfectly with mobile wallets, making money management even more convenient and secure. That’s why investing in an innovative software development solution is an investment in your future.

Time to Talk?

With all the advantages payroll—and other prepaid cards—offer, this may be a good time to talk to an expert about developing a program.

Softjourn has an excellent track record of integrating prepaid card programs with existing systems. We have also implemented a proof of concept projects that have demonstrated the value of offering employees this option. If you’d like to know more how we can put you on the road to offering your employees freedom and flexibility, please contact us.

Source: SOFTJOURN INC.